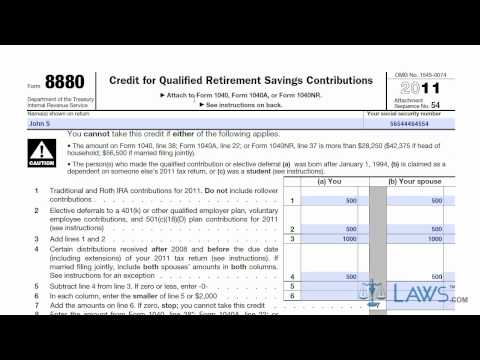

Laws calm legal forms guide form 8888 states. Internal Revenue Service tax form used to apply for tax credits for qualified retirement savings contributions. This tax credit can apply to various retirement savings plans, including Roth IRAs, 401 Ks, 403 Bs, and other IRAs. Form 8888 can be obtained through the IRS's website or by obtaining the documents through a local tax office. The form must be submitted along with your regular income tax return forms, usually the 1040. It can only be applied for individuals who earned less than twenty-eight thousand, two hundred fifty dollars, head of households earning less than forty-two thousand, three hundred seventy-five dollars, or joint filers earning less than twenty-six thousand, five hundred dollars. Enter your name and social security number at the top of the form. Enter your IRA contributions on line one, for both you and your spouse. Enter any elective deferrals or qualified plans on line two, for both you and your spouse. Add the amounts from lines one and two and enter the total amount on line three. Enter the certain distributions for both you and your spouse on line four, only use amounts after 2008 and before the due date if filed jointly. Add up the total for both you and your spouse on line four. Next, subtract line four from line three. If less than zero, enter zero on line five. For line six, enter the smaller of line five or two thousand dollars in each. Add the amounts together on line six and enter this total on line seven. Enter your income from form 1040 line 38 on line eight. Multiply your qualified amount by the decimal corresponding to your income on line nine. Enter the amount on line ten. Complete the form by entering the appropriate amounts...

Award-winning PDF software

5329 instructions 2019-2025 Form: What You Should Know

Form 5329 is not required unless a penalty is imposed or a penalty waiver is applied. Form 5329: Additional Taxes on Qualified Plan Form 5329 Form 5329 provides an individual the opportunity to report on IRS Form 5329 those taxes they might owe for non-qualified plans such as retirement plans, educational savings accounts or life insurance policies. You will need to report those amounts on Form 5329. The rules about the form are described below. When you complete Form 5329 and fill in the form is called Internal Revenue Notice 5329, Additional Taxes on Qualified Retirement Plans (including IRAs). The date and address for completing Form 5329 on your IRS tax return is the date on which you complete Form 5329. When filing a return, you do not need to complete Form 5329 unless you have income that was subject to tax for a taxable year which includes a return for that taxable year and a non-qualified retirement plan for which you would owe tax. Payment of Any Penalty. When you file Form 5329 on your return for any taxable year in which you owe other taxes and have a non-qualified retirement plan or other tax-favored account for which you would owe tax, the IRS could charge the required penalty for the year of payment of that penalty. Payments in advance of filing do not satisfy filing a return as a penalty. You must actually owe the penalty for the applicable taxable year. Reporting the Information. When you file Form 5329 on your return, you report the amount of tax you owe to the Internal Revenue Service. You must also enter on Form 5329 whether you received a penalty waiver for that taxable year from the IRS. If you received a penalty waiver, enter the amount of the waiver you received and the tax you paid. If you did not receive a penalty waiver, enter the amount of the penalty you are owed by the amount you entered the correct amount of tax on Form 5329. If you paid the correct amount of tax, you may be penalized for that amount in the future. Form 5329.pdf — Form 5329 for Individuals Form 5329.pdf is a new document that may be filed and filed electronically using the IRS Website through your online account. To print this form, you need to be online and register at the benefits portal.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5329, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5329 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5329 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5329 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5329 Instructions 2019-2025