Hi, I'm Mark. For attacks comm if you've received retirement payments throughout the year from your pension annuity IRA or similar plan, you'll receive a form 1099 - R as a report of the fund distribution. After an employee retires or becomes disabled, he or she can begin receiving pension and annuity distributions. If the employee made contributions after tax, only a portion of the retirement payments are subject to tax. On the other hand, contributions made pre-tax are normally entirely included in taxable income when distributed. When a taxpayer chooses to redirect retirement funds from one account to another without paying the taxes, they are ing a rollover. Form 1099 - R will specify any direct rollovers in 7 with either g or age codes. Any payments received prior to the taxpayer turning 59 and a half years of age are considered early distribution and are subject to additional taxes. The government stills a 10% tax on early distribution in an effort to stay people away from using their retirement funds for other purposes. In addition to the federal government, early distributions may be subject to state penalties. There are a few exceptions which may alter the installation of this 10% tax to the entire distribution amount. Some of these exceptions are death, disability, medical expenses greater than 10% of your AGI, and an IRS levy. For more information, visit attacks dot-com.

Award-winning PDF software

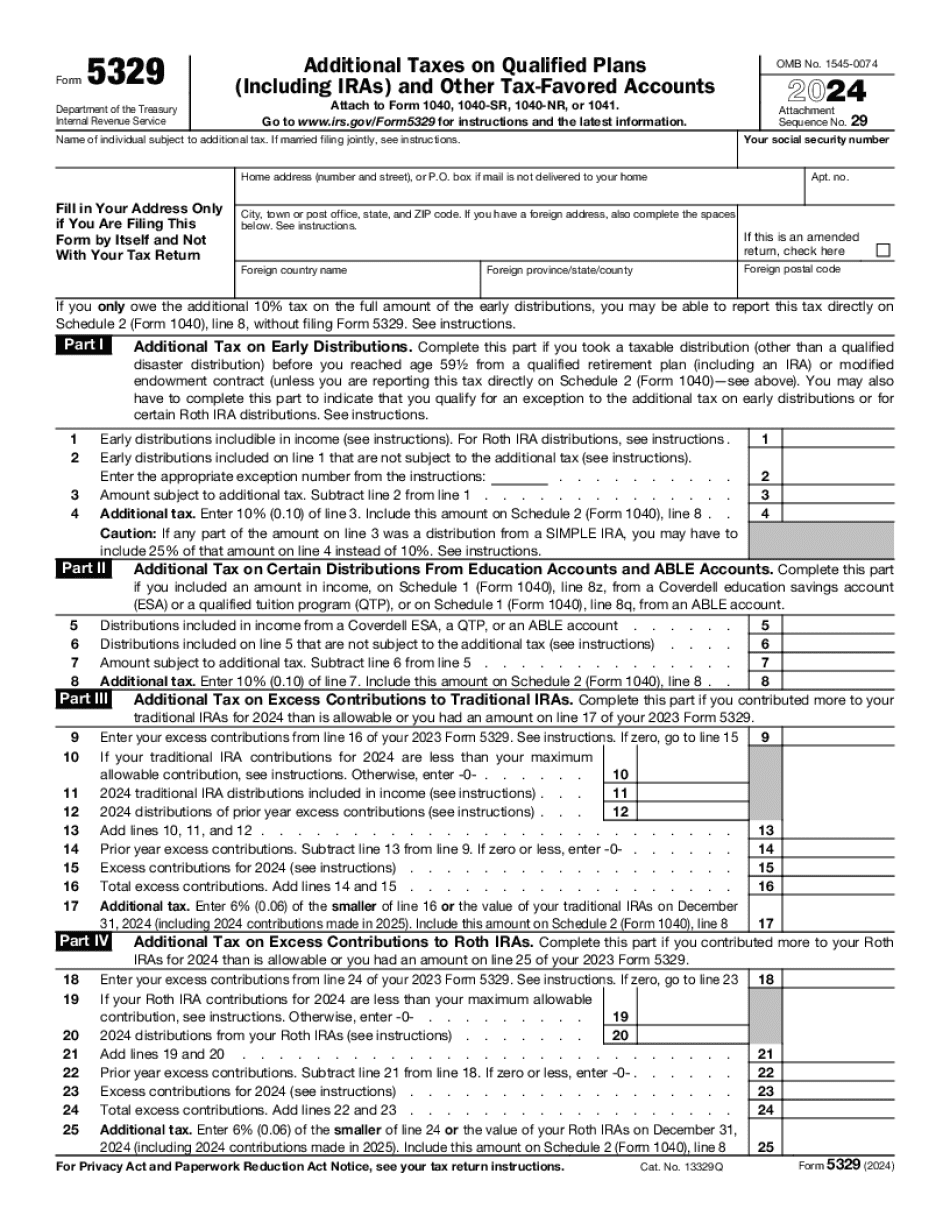

5329 2019-2025 Form: What You Should Know

Form 5329, Additional Taxes on Qualified Retirement Plans (including IRAs) and Other Tax-Favored Accounts — IRS About Form 5329, Additional Taxes on Qualified Retirement How to use Form 5329 if you owe the excess contribution penalty for 2017 Form 5329 is used if you owe the excess contribution penalty for 2017. It allows you to elect to pay the excess contribution penalty, rather than paying a 10% penalty (which you are legally allowed to do). Enter your total excess contributions in box 4. On line 7, report any other contributions you made after January 1, 2017. Complete line 6—that's the penalty paid. If you received multiple payments: Complete line 5. If the excess contributions were less than 10,000 — enter the total in box 3. If the excess contributions were less than 11,250 — enter the total in box 4. If the excess contributions were less than 12,000 and less than 15,000 — enter 14,000. If the excess contributions were less than 15,000 and more than 20,000 — enter 20,000. If all lines appear in the correct order, see the box on line 10. If the excess contributions exceeded 10,000, but you did not receive a payment (box 3), do not complete line 6. Send a draft for the excess contributions to the IRS at least 2 months before you make another contribution. Do not send any more drafts. If any more than two drafts are sent, the excess contributions are not reported on line 6, and you are subject to the excess-contribution penalty for both contributions made in 2025 and in a prior year. If more than one excess contribution was received, check box 4 to indicate if any contributions were made in a prior year. Report all contributions to line 6, including any payments received after January 1, 2017. If you received two or more drafts (from two or more individuals) in 2025 for the same excess contribution penalty, you will not receive a draft because you have not made any additional contributions at the time. If you were entitled to a penalty relief (for instance, because you got your money back from your 401k plan after the bonus distributions from a 401k plan), see “Form 5329, Additional Taxes on Qualified Retirement Plans (including IRAs),” on page 6 of Publication 590, Tax Guide for Small Business.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5329, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5329 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5329 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5329 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5329 2019-2025