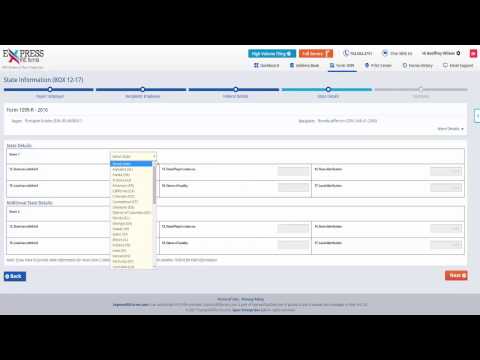

Welcome to Express IRS forms! We are one of the fastest and easiest IRS authorized e-filing programs for 1099s on the market. There are 11 different variations of forms in the IRS Form 1099 series, which are used to report income received from sources other than a main job or wage. With Express IRS forms, it is now easier than ever to e-file your 1099 form and remain compliant with the IRS. This specific form, 1099-R, reports distributions of $10 or more from pensions, annuities, retirement plans, insurance contracts, etc., made during the year. It's important to note that the deadlines for filing 1099s have changed. The recipient copy deadline is now January 31st, the paper filing deadline is now February 28th, and the e-filing deadline is now March 31st. You can securely e-file your forms with an authorized IRS agent like Express IRS forms. As an IRS authorized e-filing provider, we help you easily and quickly e-file your forms directly with the IRS. Experience how easy form 1099-R filing can be by visiting our website, w-w-w Express IRS forms comm. Click on "Get Started" to register for Express IRS forms and enter the necessary account information to create your account. After creating your account, you can select to create and edit forms from your dashboard. The first step is selecting your payor/employer. If you already have employer details in your address book, you can auto-fill the required information by selecting the employer from your records. Next, you can add employee and form details individually or by bulk upload. To add an employee individually, enter their name, social security number, and address. Proceed to the employee page to enter their federal details. Remember, you can only enter one employee's federal details at a time, so select one employee and click "Next" to enter their...

Award-winning PDF software

Irs 5329 instructions 2019-2025 Form: What You Should Know

Results 83 – 104 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts (Annual). Results 105 – 123 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2018. Results 124-131 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2019. Results 132-151 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts (Annual), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2020. Results 152 – 174 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2021. Results 175-181 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2022. Results 182-186 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts (Annual), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2023. Results 187-204 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts (Annual), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2024. Results 205-221 of 82 — Inst 5329, Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts (Annual), Notice of Qualified Separate Line of Business, 1220, 12/18/2020, 2025.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5329, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5329 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5329 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5329 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 5329 Instructions 2019-2025