I mean, brilliant. Today, I'm going to fill out the homeschooling home instruction plan or individualized home instruction plan for grades 1 to 6 with you. So, I'm gonna go through our homeschooling form here, which I received in my packet after sending in my letter of intent this year. I figured it's just a great way to show you how to break it down and fill it out because I know sometimes you just want somebody to hold your hand and help you with it. Let's get started, okay guys? Let's get down to business. Today, we are filling out the homeschooling individualized home instruction plan or I-HIP. This is for grades 1 to 6, and it is the instructional requirements. Basically, we are going to write out the curriculum we chose for this upcoming school year, which for this recording is 2017 to 2018. I just wanted to go through this with you because I know sometimes it's a little scary when you're starting out and you really could use somebody holding your hand and going through it with you. I knew I wanted that last year, so I'm just gonna go through it. Ours we got and it was a little bit filled out on the top, but I erased it so that you wouldn't see all our private information and I can go through it with you. So, in the beginning, you're gonna need to put your child's information. You're gonna put their last name, their first name, their date of birth, the grade level for this year, and their 98th NYC student ID number, if they have one. So, if they went to school like a traditional school previously, they will have one of these. You can check their report card or something like that...

Award-winning PDF software

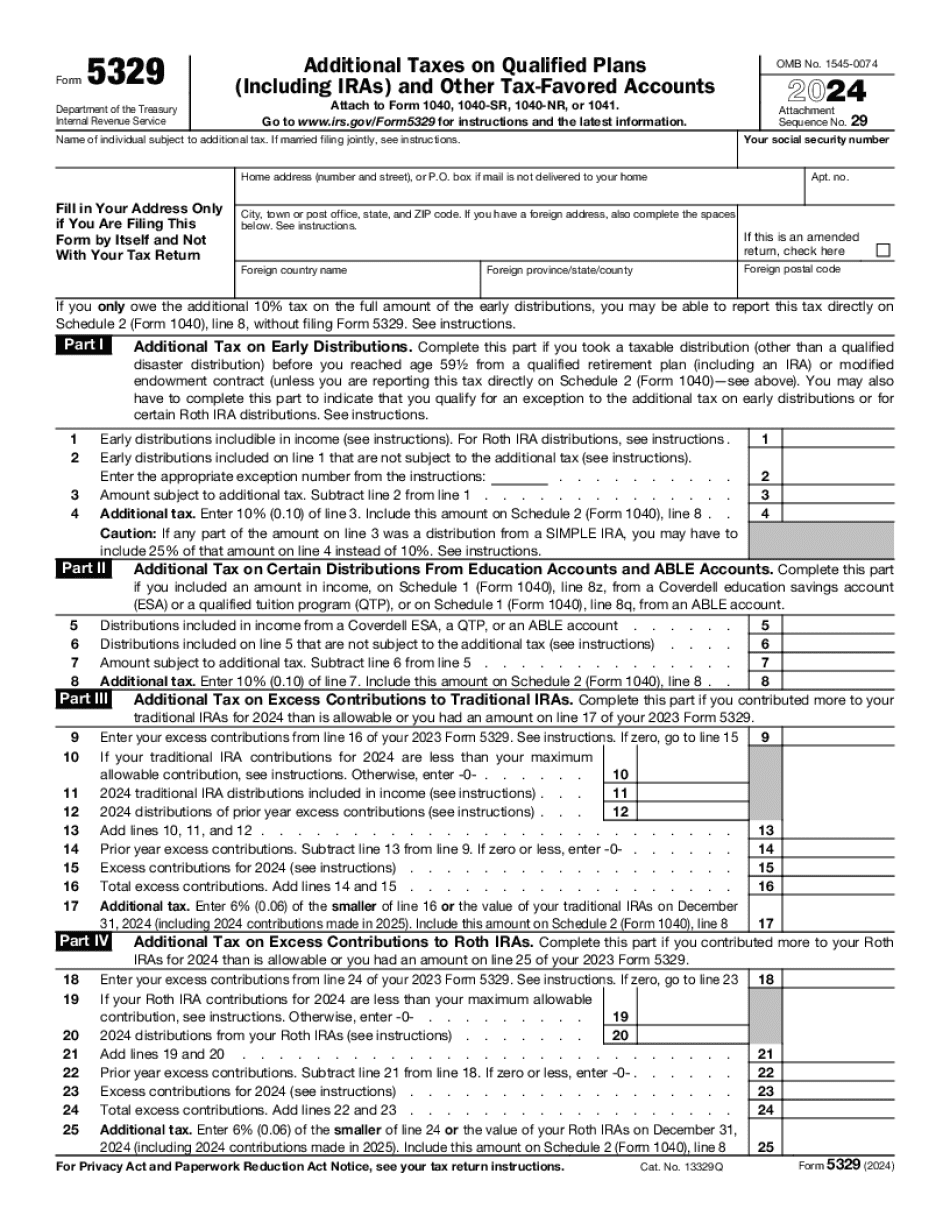

Instruction for 5329 Form: What You Should Know

An example is someone who is retiring from a plan that is eligible to be included in his or her retirement plans (i.e. the individual was age 50 or older at the time he or she left). The individual was in the age group of 50 or older for a period of 90 days after the individual's account owner dies. An alternative method is to include the excess in the individual's taxable income. Any other person who does not have a taxable year (for example, someone receives pension or annuity benefits) who is eligible for the Additional Tax on Employee Retirement Income (ERA) could also be responsible for paying the excess on IRA in order to continue receiving Social Security Benefits or survivors' benefits. If you have received any Social Security benefits, the excess is automatically counted as Social Security benefits if it would equal or exceed the Social Security portion of his or her Current and Other Income. This form also covers excess contributions, excess accrual, and overstatement penalty. If you were a participant in a qualified retirement plan that qualifies for the additional tax, you will be required to pay the tax for a period of 60 months after the end of the taxable year. This period includes any time you worked or received Social Security benefits. A participant who is eligible for the excess contribution penalty will pay the tax on an annual basis from the time the amount is added to the IRA. The additional tax may be computed by applying certain special rules or by using formulas. For additional information on this program, contact the Department of the Treasury's FAST team.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5329, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5329 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5329 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5329 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Instruction for 5329