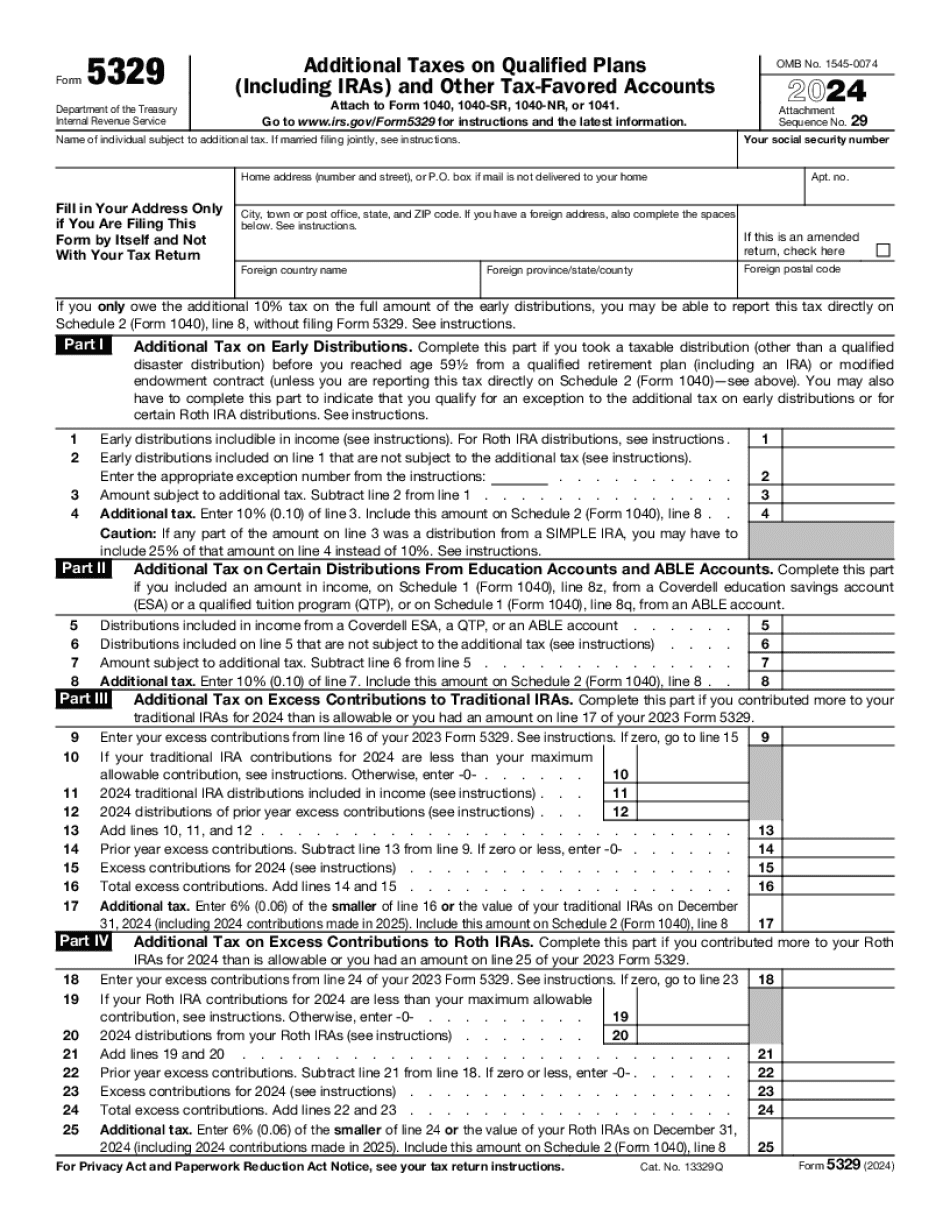

Hello, my name is Katie Sonorous with Sonorous Wealth Management. In this video, we're going to talk about how to fix a missed required minimum distribution (RMD). Let's get going. I always impose a penalty of 50% of your RMD amount, but in most cases, if you have a good cause, the IRS will waive the penalty. The steps that you have to take in order to get relief from the IRS for the payment of the 50% penalty are as follows: First of all, step number one, you have to take out your RMD as soon as possible. The first thing, as soon as you discover the omission, you have to do it. On top of that, you have to remember to take separate checks for different years. Say it's the end of 2019 and you still have to take your 2019 distribution, but you realize you forgot to take the distribution for 2018. In the month of December, you can take two distributions, one for 2018 that you missed and one for 2019, but they have to be separate checks. This is very important because you have to include the check for 2018 with your explanation that you're going to be sending to the IRS. The next step is you have to file the IRS Form 5329. What happens if you have multiple missed RMDs? We have missed RMDs for 2018 and 2017. You have to file a separate Form 5329 for each missed year. Next item, if you're married and you and your spouse both forgot to take your RMDs during the same year, each spouse must file their own Form 5329, even if you're filing married jointly. It still has to be a separate form for each spouse. Next item, if you failed to take RMDs from multiple accounts, say you...

Award-winning PDF software

Irs 5329 missed rmd 2019-2025 Form: What You Should Know

Form 8606 (Roth IRAs and Qualified Plans) Instructions to owners of private retirement plans should have a separate section on their IRS page for those who elect and complete a corrected IRS 740A Form 8606 You will want to download the PDF and view it on the Form 8606 instructions. The IRS says: A qualified tax-qualified retirement plan has a tax-deferred basis. The tax-qualified retirement plan is defined by a qualified plan beneficiary (and the qualified benefits of the qualified plan) that are includible in the owner's income. The owner is required to include in his gross income for the taxable year any amounts that remain after the qualified plan amounts in which the amount is includible. The tax-qualified retirement plan must be established by the owner before January 1, 2017, and be maintained continuously unless and until terminated. However, the owner does not have to complete and file Form 1065, Election to Have Contributions Maintained at the Same Rate, if the qualified plan includes qualified benefit payments to the owners. If you were not able to complete your 1065, you should be filing Form 8606 and should follow the procedures outlined in IRS Section 401(m). (Refer to Form 8606 Instructions for a list of items to review) You will need to complete the IRS Form 8606, and attach it to a new Form 1065 and Form 740X (you will need to use a separate address) to obtain tax-deferred (and tax-free) income for the owners. The IRS will waive the 50% tax penalty if all of your IRAs or individual retirement accounts (IRAs and individual IRAs) with a balance in excess of 3,000 were filed using Form 1095, Annual Return for Tax Year Ended December 31, 2018. Note that the IRS will only waive the penalty if all of your required minimum distribution was made to your IRA on or before July 10, 2018. In order to be able to receive this benefit from the IRS, an individual must complete a 1095 or a 740X, even though the IRS has waived the 50% tax penalties because you are a qualified plan owner. (Note that the IRS will only waive the penalty for 2025 and later tax years which has no application to you. Do the analysis for 2025 and later years on the IRS website here, on IRS.gov) “You need to see your Form 1065.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5329, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5329 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5329 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5329 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 5329 missed rmd 2019-2025