To be used as an example, since he had the wrong birth years, we gave him a different birth year. I'm not going to say in reality that he's either older or younger, but let's assume for discussion's sake that he is 68 years old and he has a million dollars in his IRA. Let's forget about dying for a moment and let's say that he takes to heart my advice: don't pay taxes now, pay taxes later. Alright, let's also assume that he has money from outside his IRA in order to spend, so he doesn't have to go into his IRA. So, his distribution when he is 68 is when it's 69. It is when he's 70. But technically, it's April first of the year following the year he turned 70 and a half, but I'm just going to simplify here. When he's 71, he must start taking his minimum required distribution of his IRA. How do you calculate that? He goes to publication 590. We obviously do it with handy-dandy software, and he gets a factor. In this case, the factor is 26.5. So, he takes 26.5 and divides that into the balance of the IRA as of December 31st of the prior year. If that number was 25, it would be exactly four percent. Okay, since it's a little bit higher than 25, then the minimum required distribution that first year is a little bit less than four percent. Then, if the money is growing, it's a five percent. Then the fun continues to grow because it's earning five. He's taking out four. But the factor for the next year is 25.6, still less than four percent, but a little bit higher than before. So his distribution goes to 45,000, and that pattern continues for a...

Award-winning PDF software

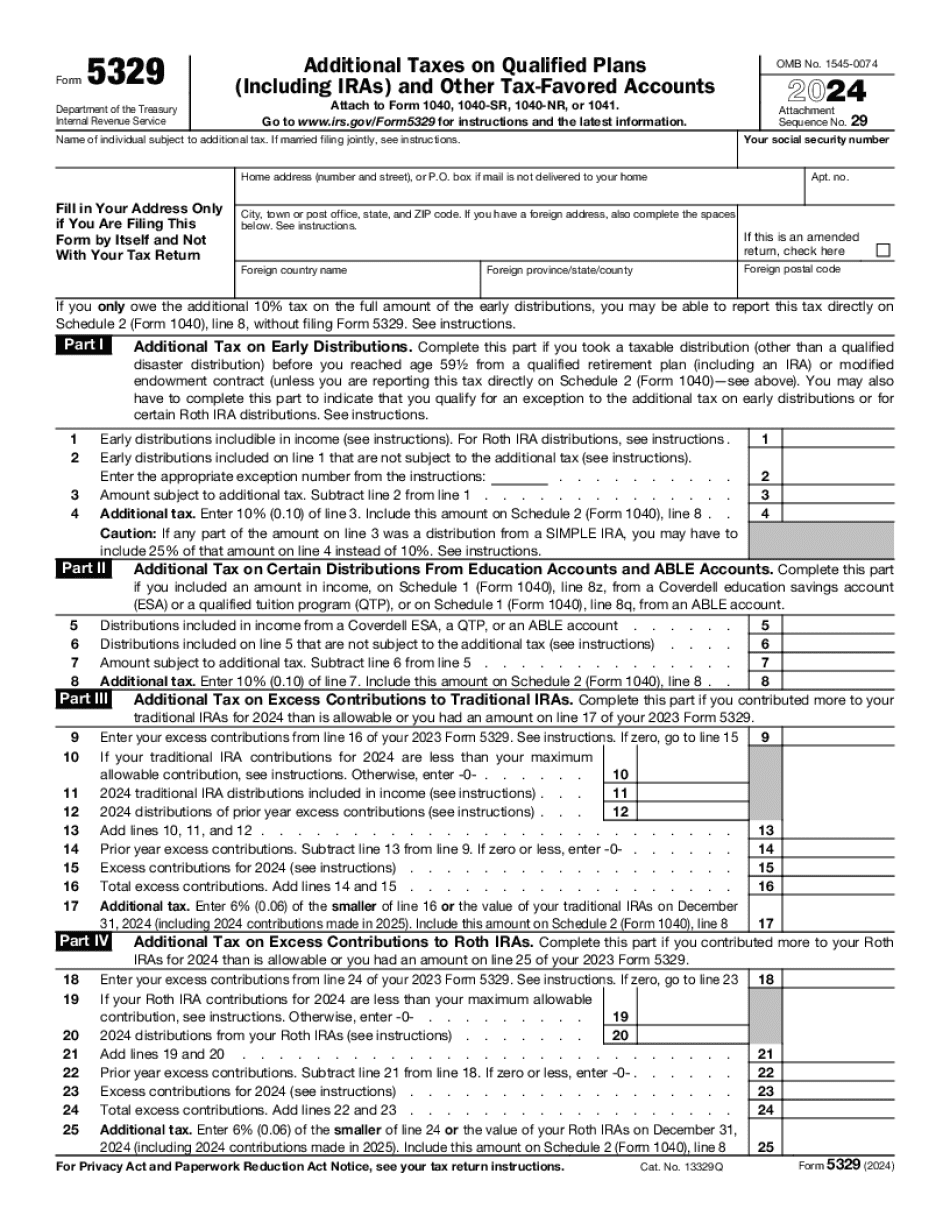

Line 48 on your 2019-2025 5329 Form: What You Should Know

If you received alimony from your former spouse, you will have income on your 2025 return and can file Form 1040 EZ. You must pay the tax to your ex-spouse if they have any state or local income tax liability. If you received alimony to be paid after your divorce If you received alimony to be paid after your marriage ended If you received alimony for a period of time in which you claimed a tax deduction for alimony paid. Do not include alimony payments that exceed the maximum tax deduction. What's the deadline for paying the back and long-term alimony? For income tax returns filed in 2025 and 2019: The back child support must be paid by February 26 of the year after the tax return was filed to the IRS. The long-term alimony must be paid by the third month after the tax return is filed. If either the tax return or alimony payments Laid off Sep. 3, 2025 — Tax return due. If you've been laid off, contact your employer and follow all instructions for payment of the back and long-term alimony. You've not received the funds, now who is responsible for paying the alimony? If you have received a notice telling you that your employer will not pay the alimony or that you must pay back the alimony to the IRS. You must submit proof to the IRS that you received the notice. You cannot rely on your mistake, you must provide proof. Sep. 20, 2025 — If you've been laid off Sep. 18, 2025 — Tax return due. If you've received a notice telling you that your employer will not pay the alimony or that you must pay back the alimony to the IRS. You must submit proof to the IRS that you received the notice. You cannot rely on your mistake, you must provide proof. If you've received a notice telling you that your employer will not pay the alimony or that you must pay back the alimony to the IRS. You must submit proof to the IRS that you received the notice. You cannot rely on your mistake, you must provide proof. If you think you've already paid for alimony; or If you think you haven't paid for alimony; and If a notice was sent to you with instructions for what to do. If you have a judgment against you Sep. 18, 2025 — Tax return due.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5329, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5329 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5329 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5329 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Line 48 on your 2019-2025 Form 5329