Downloadable PDF Form 5329 2024-2025

Show details

Hide details

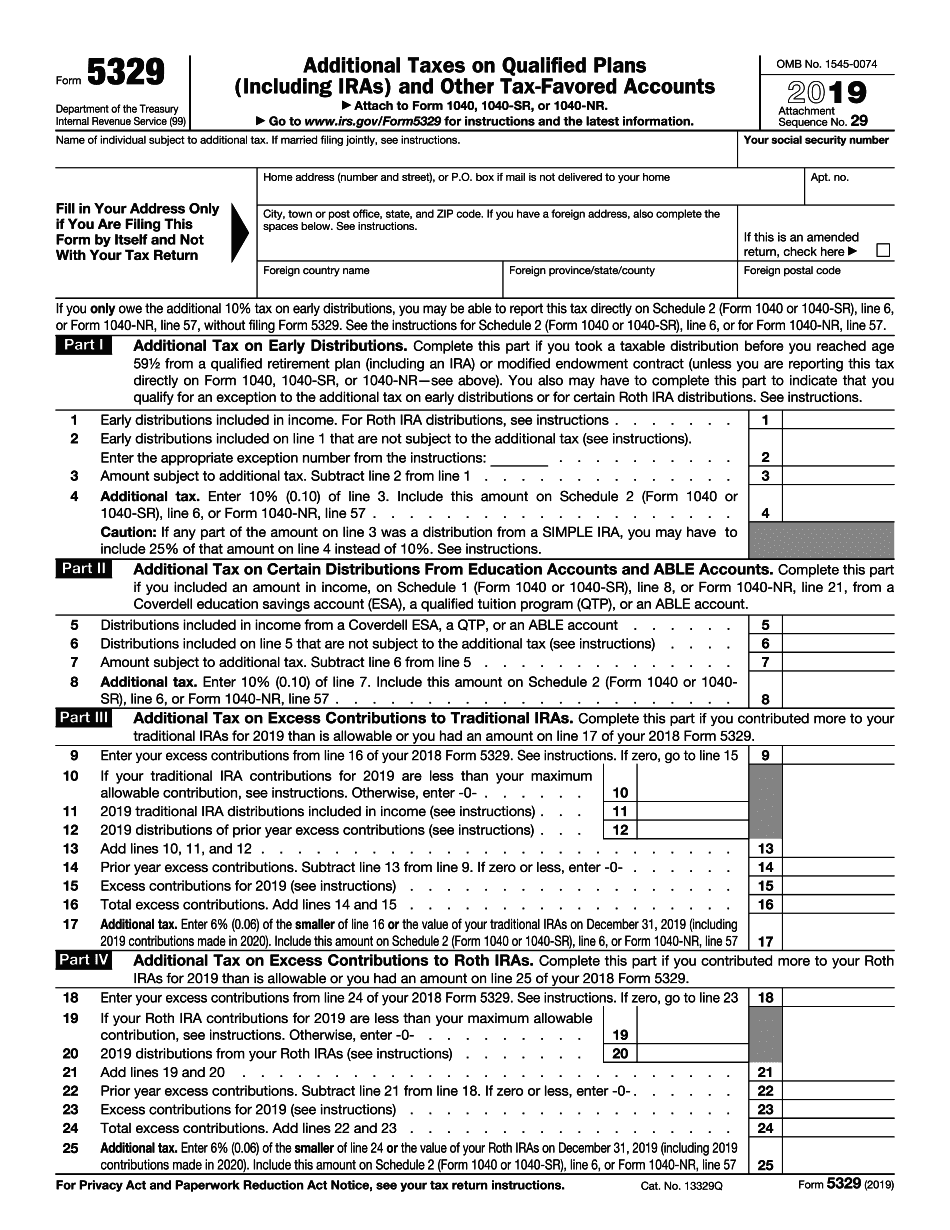

8 than is allowable or you had an amount on line 25 of your 2017 Form 5329. Add lines 35 and 36. someone on your behalf or your employer contributed more to your HSAs for 2018 than is allowable or you had an amount on line 49 of your 2017 Form 5329. Enter the excess contributions from line 32 of your 2017 Form 5329. See instructions. If zero go to line 31 If the contributions to your Coverdell ESAs for 2018 were less than the Add lines 27 and 28. Enter your excess contributions from line 16 of ...

4.5 satisfied · 46 votes

form-5329.com is not affiliated with IRS

Filling out Form 5329 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form 5329

Every person must report on their finances on time during tax season, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form 5329, our trustworthy and intuitive service is here at your disposal.

Follow the steps below to Form 5329 promptly and accurately:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official guidelines (if available) for your form fill-out and precisely provide all information required in their appropriate fields.

- 03Fill out your document utilizing the Text tool and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the toolbar above.

- 05Use the Highlight option to stress specific details and Erase if something is not relevant anymore.

- 06Click the page arrangements button on the left to rotate or remove unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or select Mail by USPS to request postal report delivery.

Opt for the simplest way to Form 5329 and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is 5329?

Online technologies allow you to arrange your document administration and boost the efficiency of your workflow. Observe the short manual to fill out Irs 5329, prevent mistakes and furnish it in a timely way:

How to complete a Printable Irs Form 5329 2019?

- 01On the website containing the blank, choose Start Now and pass towards the editor.

- 02Use the clues to complete the applicable fields.

- 03Include your personal information and contact details.

- 04Make sure that you enter accurate information and numbers in proper fields.

- 05Carefully examine the content of the form as well as grammar and spelling.

- 06Refer to Help section in case you have any issues or contact our Support staff.

- 07Put an digital signature on your 5329 printable while using the assistance of Sign Tool.

- 08Once the form is done, click Done.

- 09Distribute the prepared form by way of electronic mail or fax, print it out or download on your device.

PDF editor enables you to make alterations to your 5329 Fill Online from any internet linked gadget, personalize it based on your needs, sign it electronically and distribute in different approaches.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 5329?

How do I use Form 5329 to determine whether a taxpayer has a substantial nonexempt interest in a qualified partnership or limited partnership? (1) You used Form 5329 to determine whether any of the following taxpayers had a substantial nonexempt interest in a qualified partnership or limited partnership: (a) A partner who had a controlling interest; (b) The employee who had the last-known position as a partner; (c) One or more officers of the partnership who had a controlling interest; or (d) An administrator. (2) See Regulations section 1.863-5(b)(1) for more information. How do I file Form 5329? (1) The requirements for filing Form 5329 with respect to a taxpayer are the same as those for filing a return for the taxable year in which the relationship with each partner terminated. (2) You must file Form 5329 by the due date (including extensions) for the return that is the most recent taxable year for the partnership or limited partnership or taxable year for which the information is reported under section 6111H(a)(3)(ii) or 6111H(a)(12)(ii), whichever is applicable. (3) You must certify the information contained in the return. (4) Form 5329 is not necessary for the assessment of an excise tax on income from property.

Partnerships You may elect to treat certain income, gain, losses (and certain deductions, depending on the nature of the partnership), and indebtedness as excluded from gross income. This election applies to partnerships that are not S corporations. See the instructions for Qualified Revolt Pending (Partnership Income Exclusion Withholding for Certain Excluded Partners). For more information, see Information Returns in Pub. 519. Qualified Revolt Pending (Partnership Income Exclusion Withholding), available at IRS.gov/irb/2010-10_IRB#Form_5329. Qualify Revolt Pending (Partnership Income Exclusion Withholding), available at IRS.gov/irb/2010-10_IRB#IRB430835. See Form 5329, Qualified Revolt Pending (Partnership Income Exclusion Withholding).

Who should complete Form 5329?

People who are seriously disabled, who require special medical or other assistance to live independently in the community and are unable to maintain their own living arrangements unless there is a qualified attendant or support person, can apply for a personal independence payment (PIP).

People who are in a care home, or people in permanent residential care, often have limited capacity to make decisions about their life's future. Therefore, they can sometimes get better from their condition and be more independent than someone who is able to make decisions on their own but is not as capable. Care homes often have a role through providing a place for people to live that they feel confident in. However, if the person remains in a care home for a sufficient stretch, it may be in the best interests of the individual and the care home to support them to leave and to become self-reliant. It is not possible to predict what the individual will or will not do in a particular situation.

If you are applying for a personal independence payment under Section 33 of the Act, you must also have a statutory form for the local authority to fill out if you are in a care home. If you was considered to meet your requirement for a personal independence payment or care home you will receive a letter from the authority and be provided with a copy.

This notice is in addition to the other requirements of the Act and is based on the advice of the Independent Living Consultant. If you are not satisfied with any part, or all, of this notice, then you should apply to The Secretary.

Further information

1. What is personal independence payment (PIP)

The Personal Independence Payment (PIP) is an element of the new personal independence payment (PIP) or the old incapacity benefit (IB) system. The payment enables people who are disabled and need care and support to live independently, but who cannot manage on their own in the community — for example because they lack the required level of qualifications, language ability and cognitive skills — to live in their own homes and to have the care, help, and support they need to develop their independence. You should get PIP if you are aged 18 or over, or eligible for universal credit.

2.

When do I need to complete Form 5329?

Form 5329 is a statement by an employer, sponsor or employee that the employee has met work requirements. It must be provided by the employer, sponsor or employee during the first 12 months of employment or immediately prior to the date of change of status as a full-time employee.

Form 5329 must be completed by any person who is:

Employment

Full-time employee at a site, which is an organization that manages a work force.

Frequently Asked Questions for Employment and Work Requirements:

When should an employer, sponsor or employee complete Form 5329?

Form 5329 is a statement by an employer, sponsor or employee. It must be provided by the employer, sponsor or employee during the first 12 months of employment or immediately prior to the date of change of status as a full-time employee.

The employer, sponsor or employee must update their Form 5329 if:

an employee changes from an “employee” position to a “manual worker” position at more than two (2) times monthly in a calendar year

an employer, sponsor or employee makes significant changes in either (a) employee status, work duties, compensation and/or job responsibilities

the employer, sponsor or employee becomes subject to a federal anti-labor law

Does not meet the other requirements for a Form 5329.

What should I do if your company requires employees to complete Form 5329?

The form must be on file at your company to determine eligibility. Employers, sponsors and employees are responsible to ensure that all employees are aware of the form's requirements and that all employees are required to be filed by their new employer by the date indicated on the form. If an employee fails to receive a Form 5329 by the due date for filing, the employee must meet the other requirements for a Form 5329.

Can I create my own Form 5329?

Yes. Anyone can create Form 5329. You just need a form of your choice. All it takes is for two of your friends to agree to submit a statement of common interest. You may provide a blank page on a computer or an original paper form. You have two choices. Furthermore, you can either leave out the information you are not comfortable with and just submit your own statement of common interest, or you can sign it. It is up to you whether you sign the form or leave the statement blank and just submit a statement of common interest. When you sign your form, use something you are comfortable doing. In many cases, you will have an opportunity to explain your thoughts, feelings and ideas. You are free to write the statement on anything you would like. We encourage you to write a statement of interest that you feel is most important to tell your friend that you have joined your group. In the interest of honesty, you may wish to include some following information and to tell your friends what kind of information they may be asked to provide for our record keeping purposes: your relationship to your group; your reason for joining the group.

Can I give my Form 5329 statement to my friend?

No. Unless you ask for permission, you may not give your form 5329 statement to your friend. For information about our privacy policy, refer to our privacy policy on.

Can I contact the Department of Human Resources if I have questions about joining my group?

Yes. We will be happy to answer any questions you may have related to joining a group, including what a group profile means or if you need additional information before you can join the group. We encourage you to contact us at membershipform5329.org.

How does the Division of Legislative Resources work with group leadership?

To facilitate the administration of state laws and policies related to sexual orientation, race, religion, sex, national origin or disability, the Department of Human Resources (DHR) is working closely with the Legislative Resources Coordination Committee (LRC) to identify groups interested in working together to work with the Department on legislative and policy issues that relate to sexual orientation, race, religion, sex, national origin or disability rights.

What should I do with Form 5329 when it’s complete?

When you've completed Form 5329 you do need to submit it along with the other documents, such as the N-400 form, N-400EZ and N-400F, from your employers, your former employers, and the U.S.C.C.A.

Are you supposed to file N-400 to show where you've worked?

You're not supposed to file Form N-400 to show where you've worked. Your employer must file Form 5329 or a letter with your tax return showing that you are employed for any U.S.C.C.A. work.

If I lose my Form 5329. Who must pay me the tax due on the N-400 and the RITA?

If your employer refuses to pay you for the tax due that was due on your Form 5329, you may be eligible to collect the tax due as a penalty on the RITA of which you are responsible.

Can I request that my employers pay the tax due on my Form 5329 before my Form 5329 is filed?

Federal law specifies that you may be entitled to the tax due on your Form 5329 before Form 5329 is filed. However, the IRS does not have authority to grant specific approval to pay the tax due to your employer if you have already filed your Form 5329. Any amount paid on your Form 5329 must be paid to your former employer.

I received a Form 5329 from my employer after it has already filed its Form 5329. How do you pay the tax due to my former employers?

If your former employer failed to keep a copy of its Form 5329 and you have a copy, you must pay the amount shown on your Form 5329 or a note stating that you have paid the tax to your former employer. Send any money paid to the IRS by certified or registered mail, return receipt requested (for a fee) to the address on the form of your former employer, either at the address on your Form 5329 or a note indicating that you paid the tax.

What if my Form 5329 has not been filed by the end of my period of unemployment?

If your Form 5329 has been missed by the end of your first week of unemployment and the IRS still hasn't received it, contact the IRS at. Tell them that you missed it.

How do I get my Form 5329?

The forms, including the fee schedules and application instructions, are available on the Forms and Fees webpage.

What documents do I need to attach to my Form 5329?

You (and your dependent(IES) under 17) are the primary document for your Form 5329 (and the supporting documents are not used on any other type of Form 5329). If you are a dependent of someone else and your Form 5329 is not used to make a gift to or receive an inheritance from that person, your Form 5329 or the documents used to make the Form 5329 will not be received. In these situations, you should attach a complete copy of your Form 5329 to your Federal tax return.

If you have a written living trust document, include:

a copy of the trust document and a certificate of that document;

the executor's certificate, if any, attesting to the correct names and ages of each beneficiary of the trust;

a copy of one of the names of each beneficiary on the living trust document, including any current and previous spouse(s), children, parents, grandparents, siblings or other dependents of the beneficiary(s);

an inventory, if any, of assets which is made with funds from the trust;

any other statements required by law (or any statement which would confirm the correctness of the information in the information return);

the information return for the year in question, and either an assessment of the trust's gain or a tax statement reflecting the amount of the trust asset loss; or

Other information which would clarify and supplement the information on your tax return and which would be relevant for the purpose of your return.

If you are a non-resident alien (and are not a citizen of the United States), provide a copy of any certificate or statement of your tax residence that you maintain (at your last place of residence as of the date of service of the return, or as of the date of last return under the laws of any U.S. State) or for the current year.

If you are a nonresident alien for the year, attach to your tax return a copy of any certificate, statement, report, or other document showing your U.S. income tax liability for the year which is prepared or approved by the Internal Revenue Service. For information on acceptable types of IRS documentation, see Publication 1, pages 1–100, or.

What are the different types of Form 5329?

A Form 5329 is a tax return or payment-notify for an amount of taxable income under section 6021 or 5021 or under section 6027.

What do Form 5329 and Form 6344 include?

Form 5329, the Form 5329 Payment-Notify, for taxable income under section 6021 and 52.5% of your marginal tax bracket under section 5021 must be filed by the filing due date of the return. The payment-notify is due on or before the 10th day of the 6th month following the original due date of the tax return.

For income under section 6021, the amount to be stated in the Form 5329 must be a single amount. For income under section 5021, the amount to be stated in the Form 5329 must be the sum of 7,500 (5,500 in 2014) or 9,500 (6,500 in 2014).

If you make any adjustments to the Form 5329 (for example, by adding or subtracting from a line item), you must report the adjustments on Form 6344, the Line Item Adjustments Tax Return.

A Form 5329 is issued only for income paid or payable in the next calendar year. For example, as of the beginning of December 2013, you were able to claim a credit for tax paid in 2011. To claim such a credit, you must file a claim for relief under Sec. 6511(d). The Form 5329 has no effect until filed.

If you can claim a credit for tax paid earlier in a calendar year, you should file Form 6344, a Line Item Adjustments Tax Return, as soon as you can, but before the filing due date for the most recently filed tax return.

The amount of credit described in (13) of Form 6344 must be reported on a Form 5329 (see (8)(b), above).

Other Forms

As described in Sec. 6671(b), Form 5498 has been amended to provide for the issuance to individuals of a new version of the form. The Form 5498 has two parts:

Form 5498-M, Tax Information Statement for Individuals, which must be filed by employers or self-employed persons. Form 5498-S, Self-Employment Tax Return for Individuals, which also must be filed by self-employed persons.

The Form 5498 is not an annual tax return.

How many people fill out Form 5329 each year?

Filling out Form 5329 is easy — just click on Form 5329 and select the correct answer. For many people the answer on their Form 5329 looks exactly like the answer they got when they were applying for health insurance through the exchanges.

However, the answer on their Form 5329 might have different details that make the difference between getting a health insurance approval or not.

There are four major categories for this form. You can choose which categories are to apply to:

Individual: This is the group of people you wish to apply to as a sole proprietorship. This is a group of people in the same household with the same employer and the same year in which you are filing your taxes.

This is the group of people you wish to apply to as a sole proprietorship. This is a group of people in the same household with the same employer and the same year in which you are filing your taxes. Family: This means that you've got a spouse and children living with you at an address in the United States, that are related and who live with you as a couple at the same address.

This means that you've got a spouse and children living with you at an address in the United States, that are related and who live with you as a couple at the same address. Business: This is also the group of people you wish to apply to with your business. So when is this required to be in your individual case?

This is also the group from the following list:

The group of people who are applying for work-related benefits through the Department of Labor's Employment and Training Administration (ETA). This includes Social Security, Unemployment insurance, Workers' Compensation, and more.

The group of workers who are filing for disability benefits through the SSA under the SSA's Social Security Disability Insurance program (SDI). See what you need to know about Social Security Disability Insurance.

The group of workers who are filing for Unemployment benefits through the U.S. Department of Labor.

The group of workers filing for Compensation under the United States Department of Labor's Workers' Compensation Insurance program that has been approved by the Social Security Administration.

The group of persons who are claiming coverage as dependents under the Family Medical Assistance Program (MAP) under the Department of Health and Human Services (HHS) or Medicare Part A.

Is there a due date for Form 5329?

Yes. Under the Taxpayer Relief Act of 1997, which was signed into law on December 18, 1997, there is a specific due date for Form 5329 each year. The due date is based on the tax year. The effective date of the tax relief is based on the date specified on the notice of the due date under the Taxpayer Relief Act. Form 5329 is due by June 15. Taxpayers who are subject to a new deadline under the Taxpayer Relief Act may file Form 5329 by June 15, but they must furnish a “for notice purposes” explanation of why they cannot comply with the new deadline.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here